August Review

Review

With house prices falling, interest rates rising, and football returning, August was an eventful month in the UK. However, the news affecting our gas and electricity outlook wasn’t limited to the borders of Great Britain and Northern Ireland, as events across the EU, Russia, and Australia impacted price movements.

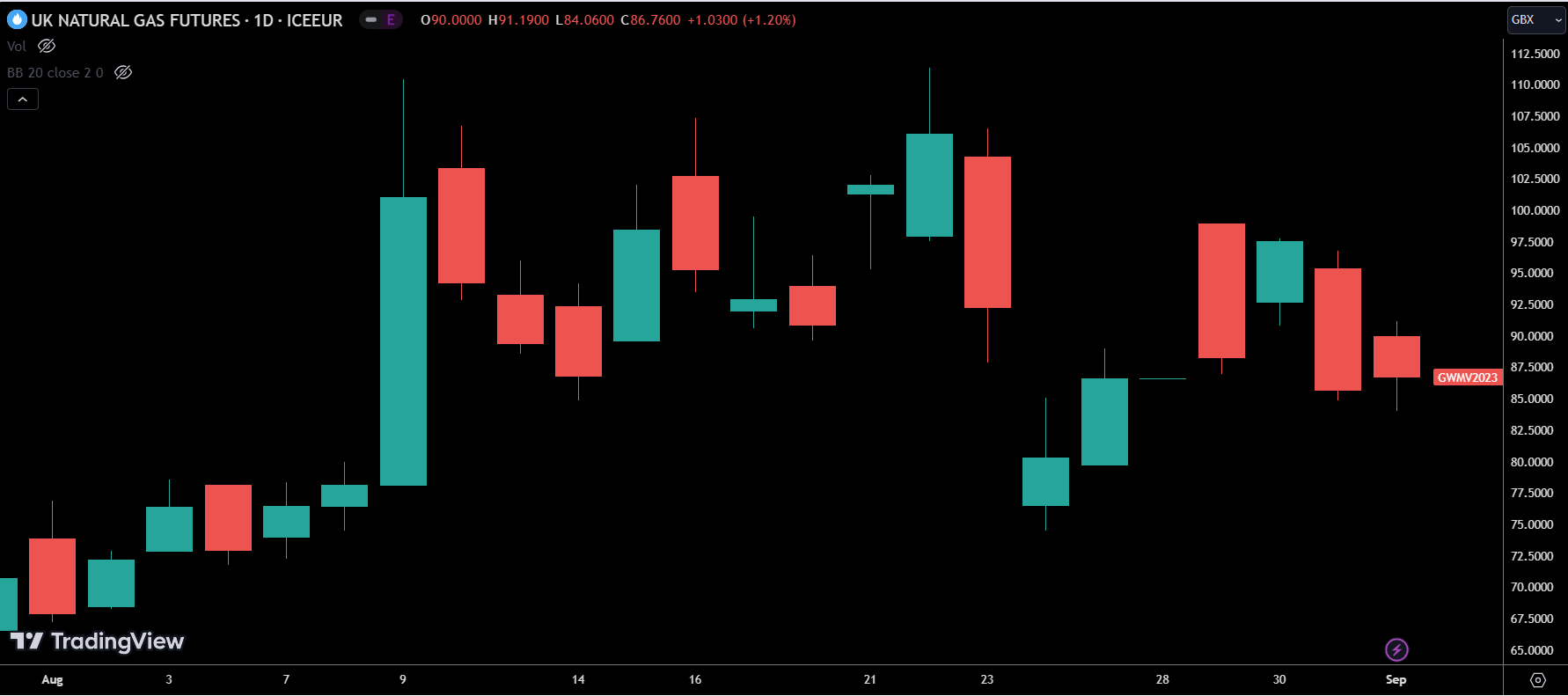

August started with wholesale gas prices slowly rising, before a large increase on the 9th. Prices would hold around this level until the 24th, when they dropped the levels seen before the rise of 15 days previous. The final week of the month saw prices steadily increase to end the month over 20% higher than they were at the end of July.

What was responsible for this increase in price?

The major story affecting UK gas prices this month was the threat of a strike from Australian liquid natural gas (LNG) suppliers. Rumours began circulating that workers at the Chevron plants in Western Australia were considering striking, and this led to an almost 30% increase on the 9th. Australia is responsible for around 10% of global LNG exports, so the impact of these strikes would not simply be limited to a few geographical markets.

After prices dropped in the days immediately following the initial rumours, they rose again on the 21st when a union statement was released stating that a strike could take place within 2 weeks.

However, on the 24th it was announced that an agreement in principle had been reached with the unions. With fears quelled, it seemed as though price would stay around the range seen before the initial rumours of industrial action.

On the 29th there proved to be one more twist, as it was announced that a strike will take place from the 7th of September. This didn’t have a particularly negative impact on the market, but leaves the door open for supply disruptions in September and remains an issue with the potential to cause disruption.

Domestically, there were concerns that hospitality industries are being mistreated by some suppliers. UKHospitality, the trade body representing the hospitality industry, called upon Ofgem to review issues facing the sector, including: requiring large deposits, refusing to work with the sector, or refusing to renegotiate contracts. Ofgem is currently consulting with the hospitality industry to conduct a thorough market review.

In more positive news, European gas storage levels are reaching capacity faster than anticipated. Last year a target was set to have gas storage capacity at 90% by November 1st 2023, a target that has now seemingly been reached. While unexpectedly cold weather can still cause larger than anticipated gas consumption, healthy reserve levels should help the continent avoid the large spikes in price seen in 2022.

Despite the success in achieving a healthy reserve capacity, it appears that not all EU goals are on course to being achieved. The EU aims to no longer be importers of Russian gas by 2027, yet the first 7 months of this year saw Belgium and Spain as the 2nd and 3rd largest importers of LNG. Reliance on some form of Russian gas seems inevitable in the near term, as the EU seeks to find further ways to reduce gas consumption.

Outlook

Going forward it seems as though the gas costs involved in UK electricity generation are likely to increase. The Department for Energy Security and Net Zero have forecast that these costs will increase by 35% by 2025. Although it wasn’t all doom and gloom, as the same report stated that renewable energy generation costs are expected to fall during this same time period, with solar and offshore wind looking like the most viable options in offsetting the increased gas costs.

Looking ahead to 2024, it seems gas and oil production in the North sea is likely to be reduced. Ithaca energy announced that they will be reducing their North sea oil and gas production as a response to the UK government’s windfall tax. The Energy Profits Levy has led to the cancellation and deferral of numerous projects that had been slated to take place during the next 18 months.

While the EU has accumulated a significant gas reserve level, we are still seeing threats to the supply side having the largest impact on price. As we head into the winter months we can expect any news regarding supply side disruption, or any news regarding colder than expect winter months to have a negative impact on price. For those looking at securing new contracts in the coming months, or purchasing their winter energy, then it seems that now may best time to buy and avoid leaving your energy costs at the mercy of the news cycle or weather forecasts.