October 2024 Review

October Review

By Adam Novakovic

As we head into the winter months, gas prices and availability become a higher priority for many businesses and households. In this month’s review we’ll be looking at the factors set to dictate how gas prices move over the coming season.

October started with fear in the energy markets as Iran launched retaliatory strikes against Israel. Worries of the conflict expanding have been a repetitive theme in energy markets for the past year and it seemed as though that was unlikely to change.

The increased military activity had led to rising prices, however, as the month progressed, hopes of a possible ceasefire have increased with leadership on both sides signalling they may be willing to put an end to hostilities. How this plays out over the coming days and weeks could be a key factor in the stability of energy prices throughout the coming winter.

Meteorological forecasts have now confirmed that the UK is likely to see a La Niña winter. La Niña weather patterns refer to cooling oceans and strong winds which will have an impact on British conditions. During La Niña winters it is more likely that the UK will see a cold start to winter, a milder end, and a wet Spring. A milder end to winter would bring relief and take any pressure of the gas reserves which are currently close to being 100% full. The current forecasts make it seem unlikely that a winter of sustained cold temperatures (when compared to historic averages) is forthcoming.

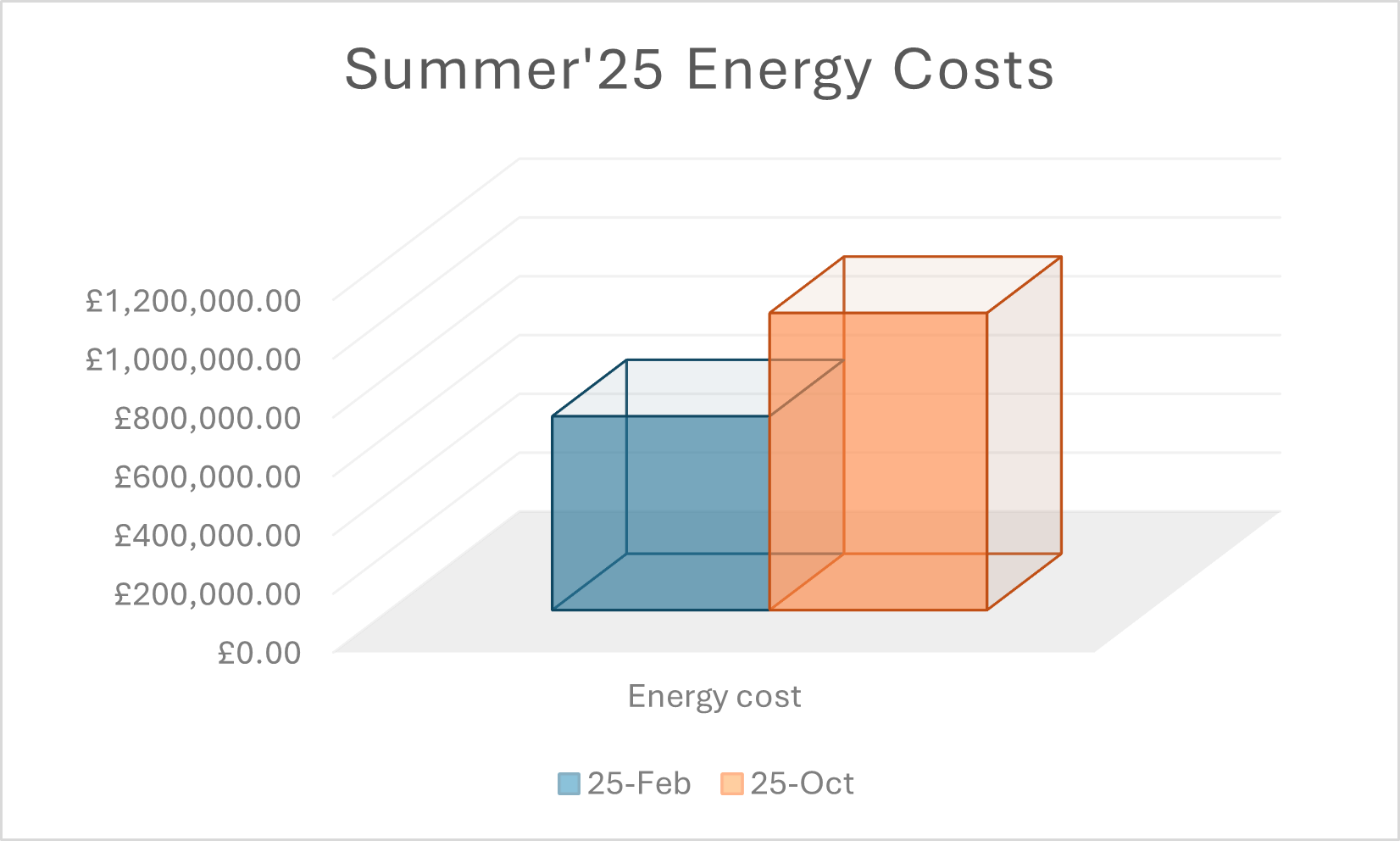

A POWWR energy report released in October has shown that business energy spending is increasing with businesses using 4.1% more energy during the past quarter. Energy prices remain a key concern for many high-consuming industries. Since the end of February, prices have been steadily rising. The wholesale energy prices for gas on October 31st were more than 80% higher than they were in late February.

For a manufacturing business with a 3GWh summer consumption, the difference between purchasing next summer’s energy back in February compared to today, is a difference of approximately £350k.

This highlights the importance of timing the market and receiving energy advice you can trust. If you would like more information about how to time the energy markets to ensure your business doesn’t pay more than necessary, contact me at adam@seemoreenergy.co.uk and I’ll see how I can help with your energy procurement.

Outlook

There is expected to be news before the end of the year on how the transit of Russian gas could continue beyond 2024. Recent negotiations are yet to yield any solid results, but with time running out, new gas transit deals would have a positive impact on lowering prices if/when they are announced.

The International Energy Agency released their global energy outlook during October. Despite the negativity surrounding energy markets in recent months, we are approaching a future where oil and gas surpluses seem likely. Unless there are significant increases in consumption patterns, it seems that these surpluses could lead to lower energy prices in the coming years.

With reserve levels healthy and the weather forecasts not causing alarm, it seems like only geopolitical events or pipeline disruptions could cause further price rises. In the financial markets we are seeing firms who previously expected prices to rise reversing their position, leading many to believe that November could be the month where we see the trend of rising gas prices to reverse.

If you require advice about your upcoming contract renewals and would like to know what type/duration of contract could be best for your business, contact us today to speak to experienced advisors who can help you with bespoke strategies and advice that is tailored to your needs.