March 2025 Review

March 2025 Review

By Adam Novakovic

As we exit the winter season and the weather begins to improve, the energy news has – once again -- been dominated by the conflict between Russia and Ukraine.

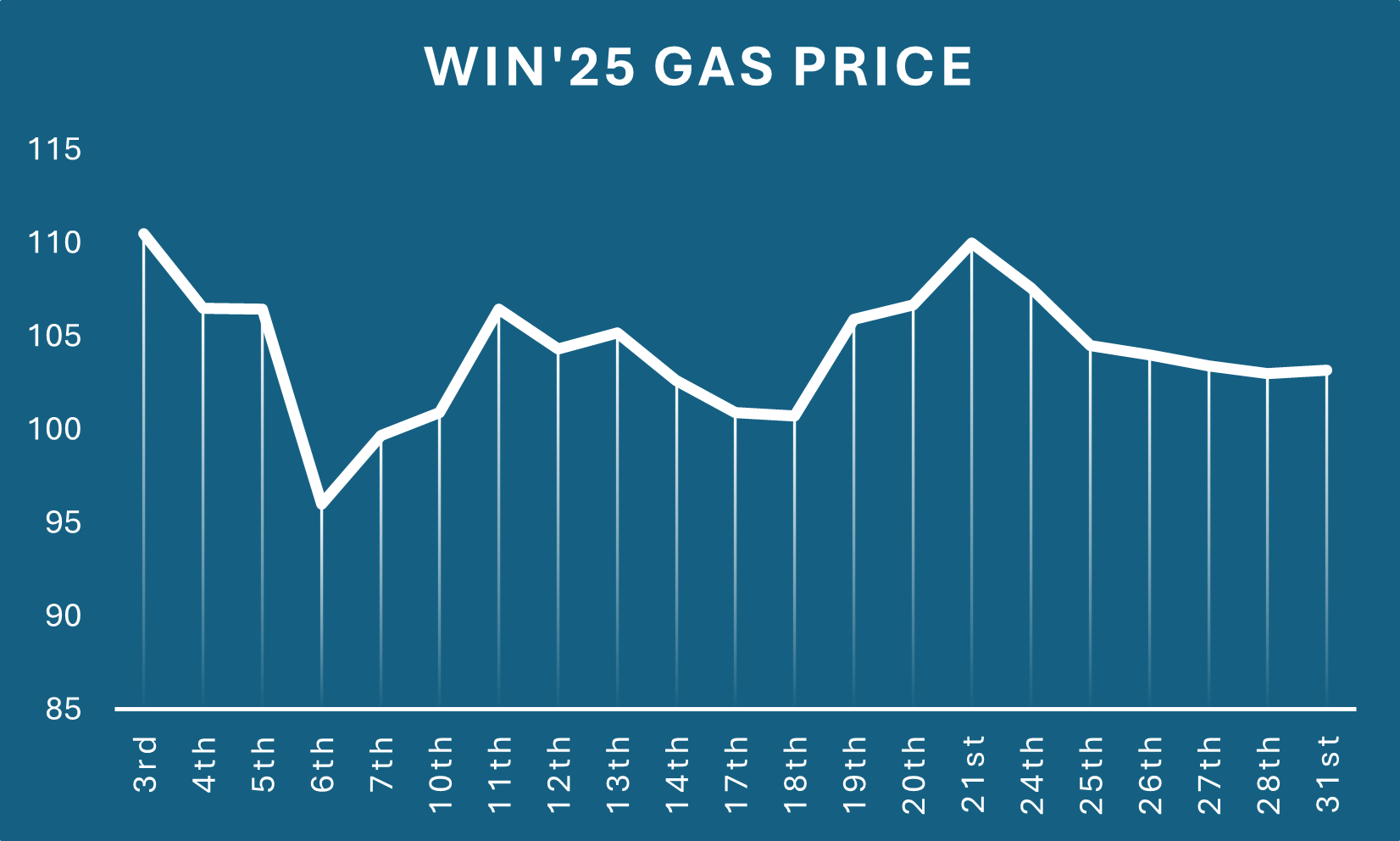

Throughout March we saw a steady decline in energy prices. The gas prices for Winter’25 dropped by 6.61% during the month. This would represent a saving of £14,600 for a business forecast to consume 200,000 therms during this period.

The month began with positive news that would cause a sharp drop in prices. One of the most significant factors impacting the demand for gas in 2025 is the mandated gas reserve targets imposed upon EU nations. These targets force countries to buy until their gas reserve levels meet the pre-mandated target, however, talks have begun to add some flexibility to these mandatory reserve levels. There has been a recognition that all member states having to make purchases at the same time will impact the supply-demand balance in the market and likely cause price spikes around the various intermediate deadlines currently in place. Proposals on any possible changes are currently being finalised, with a final decision to be made within weeks.

European gas storage levels remain low, especially when compared to this time in recent years. With discussions about the possibility of Russian gas being available for purchase later this year, this may be a sign that European nations prefer to wait, rather than paying higher prices for imports currently available from Asia and the US.

The potential for peace between Russia and Ukraine had caused prices to drop sharply in February. However, March began with a meeting between Trump and Zelenskyy that highlighted disagreements in how the peace talks should be handled. Whilst this was initially a cause for concern, shortly afterwards Ukraine would propose a 30-day cessation of hostilities, showing their willingness to achieve a resolution to the conflict.

An agreement had been made for 2 nations to agree to immediately cease any attacks on energy infrastructure, only for there to be an attack on the Sudzha gas metering facility shortly after. Both parties denied responsibility for the attack, blaming the other, and talks are set to continue throughout April.

In 2024, one of the factors that caused energy prices to rise was an LNG bidding war between European and Asian nations amid a heatwave that led to increased consumption in Asia. This year, we are seeing Chinese LNG imports slow, with reports suggesting LNG imports have dropped by over 20%. This has been caused by increased domestic consumption and lower industrial use. If this pattern continues, it will be good news for European nations that rely on LNG imports, especially the UK who import heavily from Qatar.

Outlook

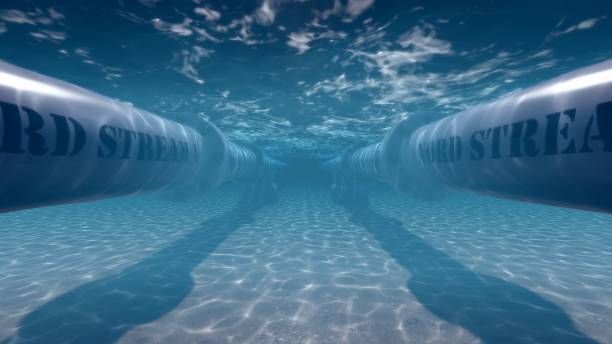

Discussions have taken place between the US and Russia about the resumption of Russia gas exports to Europe. With the ability to restart the Nordstream pipeline on short-notice, Russia has the ability to send large quantities of gas into Germany, which could then be sent to other European nations. After a colder than anticipated winter, and with gas reserve levels low, it may be in Europe’s best interests to lift the existing sanctions on Russian gas. With further talks taking place over the coming weeks, we will likely see whether this becomes a pivotal part of a peace deal and how receptive European leaders are to the resumption of Russian gas flows.

With prices having already dropped following the talks of the EU showing flexibility with the mandatory gas reserve targets, any positive news regarding this will likely lead to further drops in price.

The main threat to gas and electricity prices is still the resumption or escalation of hostilities between Russia and Ukraine. Even though the market has responded positively to the initial talks, we could see prices rise again if negotiations falter.

If your business requires advice with its energy procurement, management, or planning, then don’t hesitate to contact Seemore Energy to speak to experienced advisors who can help you with bespoke strategies and advice that is tailored to your needs.