2023 Review

2023 Review

After the turbulence of 2022, we saw some large steps back to the path of normality in 2023. The inflated energy prices that had threatened many UK businesses in ’22 slowly subsided, and while they haven’t quite gone back to the levels we saw in the previous decade, they have seemed to head in the right direction.

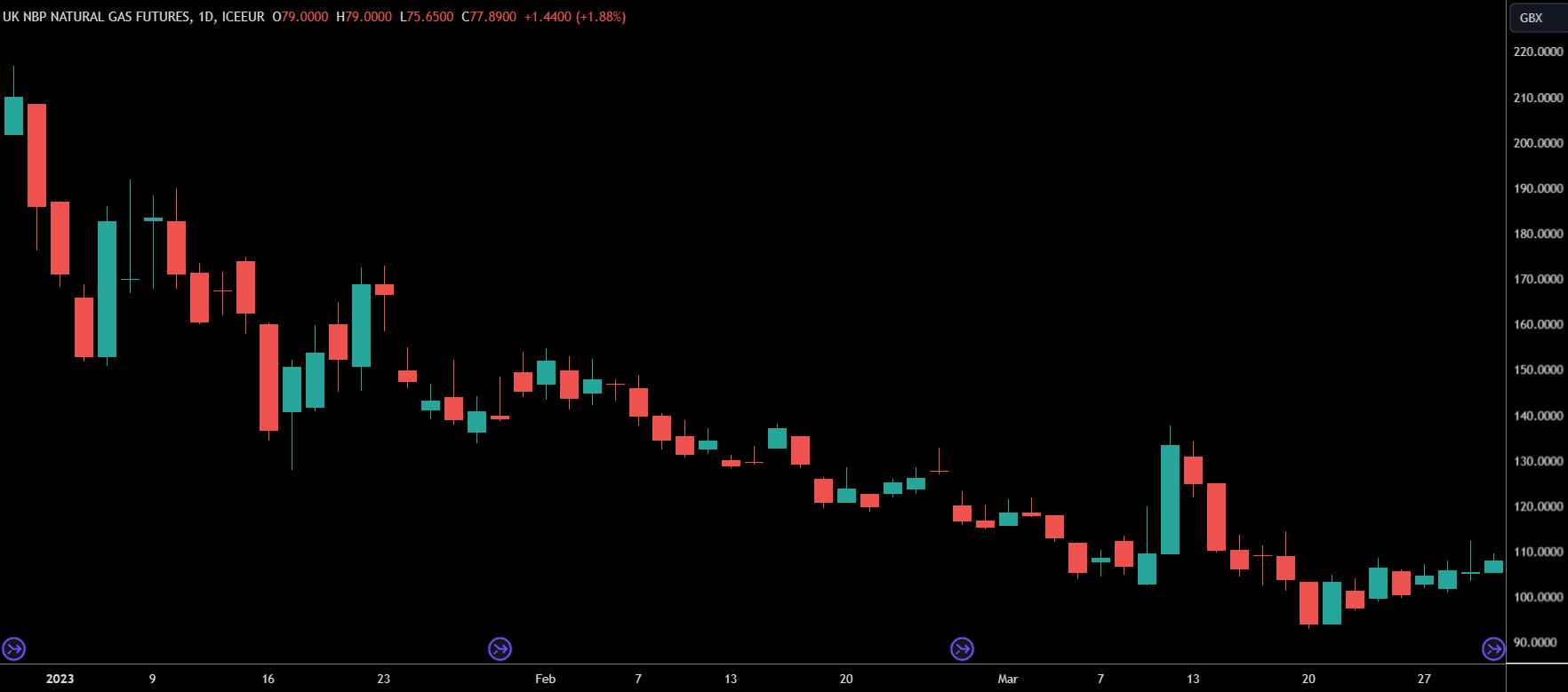

The 2023 wholesale gas chart

Quarter 1

As the year began, Day Ahead (DA) gas was priced at 166.9p/therm, and the DA electricity price was £163.45/MWh. This was significantly below the peaks of 2022, but still far above historical levels. The Energy Bill Relief Scheme (EBRS) was taking some pressure off of businesses; however this was due to expire on March 31st. Worries of how businesses would cope post-EBRS were lessened as prices fell consistently throughout the first 3 months of the year.

The Q1 wholesale gas chart

A milder than expected winter had led to consumption levels being below historical averages and thus avoiding the potential gas shortages which had been extensively written about. However, there were some shortages experienced as supermarket shelves looked uncharacteristically bare. Frost in Morocco and Spain had led to shortages of vegetables and – due to the high electricity cost – it was deemed not viable to make up for the shortfall using greenhouses.

After February, fears still remained surrounding gas prices and whether they would revisit their 2022 highs, at this time we wrote “With French nuclear energy returning, European storage levels at 65% (compared to 29% last year), and Germany completing construction of it’s floating LNG terminals, the outlook is significantly more positive than it was for most of 2022.” These factors did end up contributing to the falling prices.

By the end of the quarter DA gas prices had fallen to 106p/Therm, falling more than a third during the first quarter of the year. The electricity price had fallen a similar % to close the quarter at £109.70/MWh

Quarter 2

By April journalists and politicians were willing to speak about energy prices in a more positive context. Prices had continued falling and the narrative which had been dominated by pessimists in the previous months was beginning to show signs of optimism. However, the EBRS scheme was no longer providing support, and many businesses began to feel the pain of high unit rates even as wholesale prices continued to decline.

The Q2 wholesale gas chart

Ukraine, which had been key in the catalysts responsible for seeing energy prices hit unprecedented highs, began exporting electricity again, and by the end of the month we wrote:

“While there will still be risks and some caution around the gas supply ahead of next winter there is a shift in overall sentiment, with more public figures and institutions feeling comfortable enough to express their positive views. Without any negative catalysts emerging it seems likely that wholesale prices will steadily continue to drop until such a point that market confidence is interpreted as complacency.”

In May, some of the optimism which we saw in April began to be met with caution and hesitancy. OFGEM stated that they believed prices could remain high for the next 24 months and the market sentiment was suggesting we were about to see prices stabilise or head back up. At this time we stated:

“with current wholesale prices being priced below future contracts. This shows that there is an expectation wholesale prices will rise ahead of Winter ‘23 and that we could be close to the yearly low.”

Despite these fears, the lowest gas and wholesale prices in 2023 were observed in May and early June. However, shortly after this, prices began to rise again. Disruptions to the supply of gas from Norway was seen as a key factor in these increasing prices, as well as the confirmed shutdown of gas fields in Groningen, removing one of Europe’s key contingency plans.

At the half way point of the year, DA gas prices were down to 92.6p/Therm, a decline of 12.5% during the 2nd quarter, despite being notably higher than the May lows where prices had dropped below 60p/therm. While DA electric prices had fallen to £85.83/MWh, representing an almost 50% drop since the start of the year.

Quarter 3

The Q3 wholesale gas chart

Quarter 3 saw a reversal in the trend of declining prices that had been established during the first 6 months of the year. Wholesale prices had already hit their yearly low in June, and for the remaining summer months they would slowly begin to rise.

By July, fears had started to emerge regarding the UK’s gas reserve capacity, with the market already looking forward to the winter ahead. Plans were considered to reopen disused gas storage facilities in addition to securing LNG imports for the coming months.

At the end of July we wrote:

“As we start to edge closer to winter, it seems likely that concerns about supply for the winter of 2023 will increasingly drive the price narrative. With the failure to make a new low during July it now seems unlikely that wholesale prices will go below the low of May 30th and we are likely to see steady increases for the next few months.” - This proved to be the case, as prices failed to go below the levels seen at the end of July for the remainder of the year.

In August the energy news was dominated by the threats of industrial action at Australian Chevron plants. This threatened to disrupt global energy prices as fears of LNG shortages sent prices rising. Eventually a resolution was reached and disruptions were averted, but wholesale prices still rose almost 20% during the month.

September followed the trend of rising prices seen in the previous months as disruptions to Norwegian supply further impacted the wholesale markets. Prices rose to their highest level since April during the month before subsiding by the end of the month with DA gas prices ending the quarter at 96.7p/therm, representing a small increase from the levels seen at the end of June. DA electricity prices followed a similar trend, rising slightly since the end of June with a price of £90.01/MWh.

After prices had pulled back

we said:

“we believe we have seen the market low for this year, and there are more factors that could send prices higher than factors which could see a return to the June lows. We still believe this to be the case, and that the most sensible approach would be for those on flex contracts to look at locking in a significant % of their winter demand.” - As we headed into October, prices would soon see more significant rises.

Quarter 4

Hostilities in Israel caused a sharp rise in prices during October. Initial fears that the conflict would spread across the Middle East and disrupt energy supply routes quickly proved to be unfounded, at least in the present moment, and prices steadily fell for the remainder of the month.

As we entered into the winter months, fears of cold weather causing gas shortages had been allayed by healthy supply levels been displayed across Europe.

As geopolitical news took a back seat, the biggest factor affecting the energy markets became weather, and forecasts were starting to suggest that the worst-case weather scenarios would almost certainly be avoided as the winter would be unlikely to be colder than the average winter.

Wholesale energy prices dropped throughout November, and that continued into December. This led to DA gas prices dropping to 78.45p/therm at the end of the year, the lowest price at the end of a quarter, but still above the low levels seen during the months of May and June. Whereas DA electricity saw the lowest prices of the year come near the end of December before rising slightly to close the year at £60.64/MWh, which was over a £100/MWh decrease from the prices seen at the beginning of January.

The difference in commodity costs for a business with a 1000MWh/year consumption between the start of January and the end of year would be £100,000. While this is the DA market and not a future's market, we could see than in the market for Winter'24 Electricity there were differences of £30/MWh just between the high point of November and the lowest point in December. By knowing how to time the market -- or seeking advice from those who have expertise within the market -- shrewd businesses could save themselves thousands or tens of thousands by negotiating their contract at the right time.

By the end of December, fears regarding an unexpectedly cold winter had now almost completely disappeared, and attention drifted back to international conflicts and their ability to affect international supply routes. A narrative that will remain pivotal in the first months of 2024, as it seems prices are likely to stabilise or drop further so long as energy supply routes remain free from disruption.

If you would like our monthly updates and analysis on the energy news that affects UK businesses, then sign up to our newsletter here to receive copies into your inbox, or subscribe to our newsletter on Linkedin to receive notifications whenever we publish our reviews.